Walmart Inc. experienced a significant stock surge on Thursday, reaching an all-time high of approximately $74.50 in premarket trading, a remarkable increase of over 8%. This rise follows the company’s impressive earnings results, which have instilled optimism among investors in light of the current fluctuating U.S. economy. The previous record was set just last month at $71.33.

**Key Earnings Highlights:**

- **Revenue:** For the quarter ending July 31, Walmart reported revenues of $169.3 billion, surpassing analyst expectations of $168.6 billion.

- **Earnings Per Share (EPS):** The company achieved an EPS of $0.67, beating the forecast of $0.65.

- **Outlook:** Walmart has increased its full-year sales growth forecast from 3%-4% to a new range of 3.75%-4.75%, with anticipated earnings growth of 6%-9%.

CFO John David Rainey reassured investors about consumer health, stating, “we have not seen any incremental fraying,” which is particularly encouraging amid concerns of a possible economic slowdown.

The positive performance of Walmart’s stock also buoyed the broader market, with the Dow Jones Industrial Average and S&P 500 futures rising by 0.7%, poised for their highest opening in two weeks.

**Market Insights:**

DA Davidson analyst Michael Baker emphasized a notable shift in consumer spending habits, stating, “The only place anyone is shopping right now is Amazon, Walmart, and Costco.” This trend has adversely impacted retailers focused on discretionary items, with major brands like Lululemon and Nike suffering stock declines of over 25% this year.

As trading opens at 9:30 a.m. EDT, Walmart is expected to add nearly $50 billion to its market capitalization, which is approximately three-fourths of the total market value of rival Target.

For more updates on Walmart’s performance and its implications for the retail sector, stay tuned to Star News.

More News

Tragic Plane Crash Claims Life of NASCAR Legend Greg Biffle in North Carolina

Legendary NASCAR driver Greg Biffle is among the dead after a fiery plane crash in North Carolina ... TMZ Sports has con...

Teachers of the Year Celebrated at Monday's Board Meeting

During Monday's board meeting, we were delighted to celebrate our teachers of the year. Each one of these extraordinary ...

Sheriff’s Office Investigates Construction Equipment Theft in Stoneville

STONEVILLE, N.C. — The Rockingham County Sheriff’s Office is investigating the theft of construction equipment repor...

Woman Suffers Minor Injuries After School Bus Collision in Martinsville

MARTINSVILLE, Va. — A woman was injured Thursday afternoon after being struck by a school bus at an intersection in Ma...

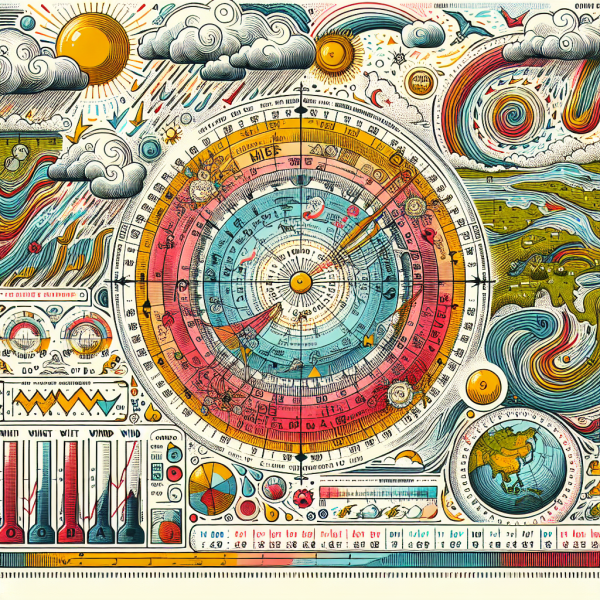

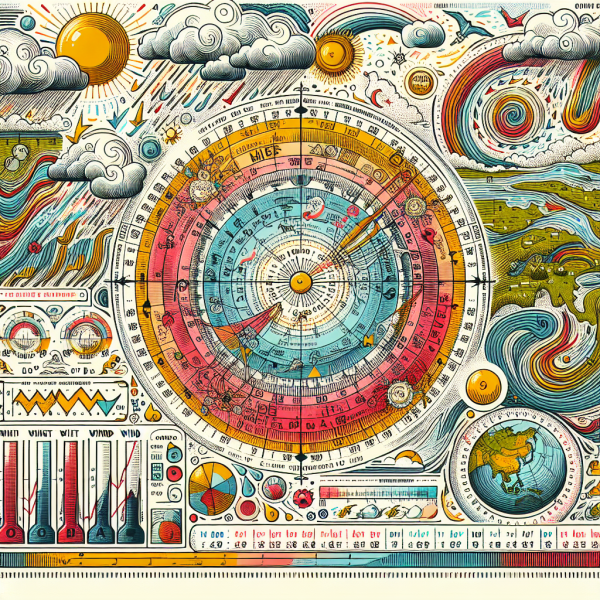

Seven-Day Weather Outlook: Mostly Dry Week with Midweek Showers

**Comprehensive Weather Analysis for the Region** **Report Scope:** This report encompasses the current meteorologic...

Seven-Day Weather Outlook: Mostly Dry Week with Midweek Showers

**Comprehensive Weather Analysis for the Region** **Report Scope:** This report encompasses the current meteorologic...